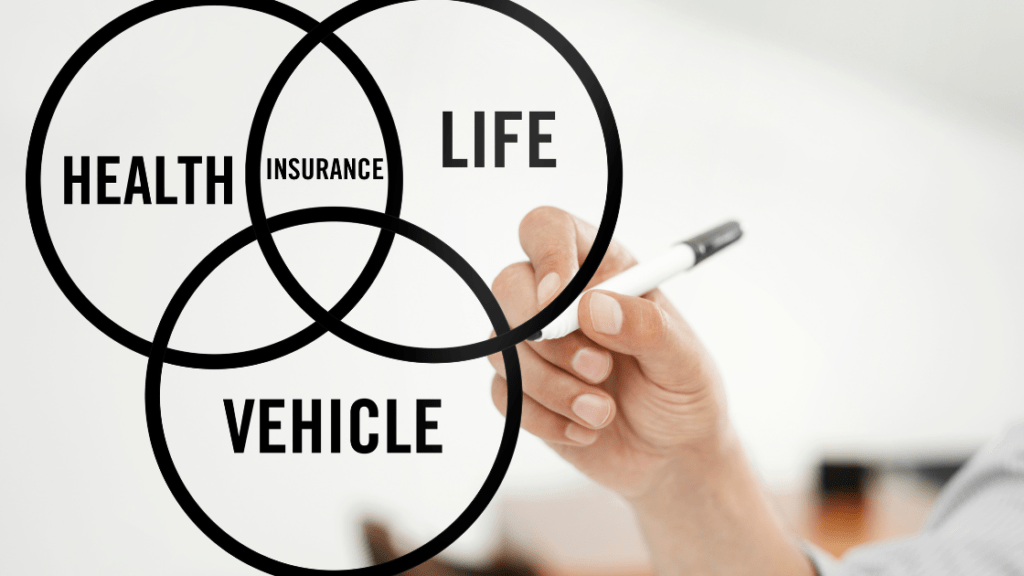

Insurance is a contract in which the insurance company undertakes to compensate the insured against the payment of consideration if a certain event occurs. Different types of insurance are contracts between the insurer and the insured under which the insurer undertakes to compensate the insured for the damage resulting from the insured risk.

Purpose of insurance

The goal is to reduce financial uncertainty and make accidental losses manageable. It does this by paying a small, well-known fee – an insurance premium – to a professional insurer in exchange for assuming the risk of a large loss and a promise to pay in the event of such a loss.

Insurance and its principles

In the insurance world, six basic principles must be adhered to, ie, insurable interest, utmost good faith, obvious cause, indemnity, subrogation, and premium.

Insurable Interest

The insurance claim that arises from a financial relationship between insured and insured is recognized by law. Insurance policies can cover medical expenses, vehicle damage, business loss or accidents during the trip, etc. Life insurance and general insurance are the two main types of insurance coverage. General insurance can be further broken down into subcategories that are broken down into different types of policies.

Insurance is a contract of indemnity

An insurance contract is an indemnity contract because both are contingent on the occurrence of an event, and both are special contracts but the general principle applies to both, a promise of indemnity is common and there must be a consideration in both.

Why is insurance important?

Insurance is a contract represented by a policy whereby an individual or entity receives financial protection or compensation against losses from an insurance company. The company pools customers’ risks to make payments more affordable for policyholders.

- Protection for you and your family

Your family deserves a good lifestyle for which your financial support is a must through insurance. This is why insurance is particularly important when you start a family. It means that the people who matter most in your life can be protected from financial hardship when the unexpected happens.

- Reduce stress during difficult times

None of us know what’s around the corner. Unforeseen tragedies—such as illness, injury, permanent disability—even death—can bring tremendous emotional distress and even grief to you and your family. With insurance, the financial stress on you or your family will be reduced and you can focus on recovery and rebuilding your life.

- To enjoy financial security

No matter what your financial situation is today, an unexpected event can unravel everything very quickly. Ins turance offers a payout so that you and your family can hopefully move forward in the event of an unforeseen event.

- Peace of mind

Money can not replace your health and well-being – and your presence is more important. Each person is playing an important role so insured yourself is safe way. But at least you can rest assured that insurance will support your family’s financial security should anything happen to you.

- Leaving a legacy

A death benefit can secure the financial future of your children and their standard of living.

- Insurance can be a good investment

At first glance, cash value life insurance doesn’t seem like a good investment compared to some traditional investment alternatives like the stock market and traditional retirement plans.

Types of insurance

The four basic types of insurance are:

- General Insurance

- Life Insurance

- Usage-Based Insurance UBI

- Reinsurance

1. General Insurance

General insurance policies are one of the types of insurance that provide lump-sum coverage against losses other than the death of the policyholder. Overall, general insurance includes different types of insurance policies that provide financial protection against damage caused by third-party liability claims such as bikes, cars, homes, health, and the like. These different general types of insurance policies include

The following are some of the types of general insurance:

- Health insurance

- Disability Insurance

- Car insurance

- Household insurance

- Travel insurance

- Pet Insurance

Let’s take a closer look at the different types of General insurance policies:

1. Health insurance

Health insurance is another of the four main types of insurance that experts recommend. A recent study found that 62% of personal bankruptcies in the US in 2007 were a direct result of health problems. A surprising seventy-eight percent of these applicants had health insurance at the onset of their illness. These numbers show that if you already have a policy, it is important to get health insurance and assess whether your coverage is adequate.

Finding affordable health insurance can be difficult, especially if you already have a medical condition or don’t have access to health insurance through your employer. Again, it can be helpful to consult with a financial advisor to determine what type of policy is right for you. Get to know HDHP vs PPO: Which is Better Health Insurance?

Cancer insurance

While it is important to have health insurance. These plans cover cancer treatment claims, but they are based on hospitalization bills. Also, the complete cost of treatment may not be covered under these plans. It also limits co-payment of treatment costs, illnesses also treated by network hospitals only, etc.

New age cancer insurance policies like ICICI Pru Heart/Cancer Protect cover are designed to overcome these limitations. If the patient is diagnosed with cancer, the insurance policy pays and there is no need to submit hospital bills. So you can use this amount for treatment with the doctor or hospital of your choice, locally or abroad. What’s more, unlike regular health insurance policies, the premium for this policy remains the same throughout the policy term.

2 . Disability insurance

Many of us doubt that we will ever become disabled and therefore refrain from taking out long-term disability insurance. However, figures show that three out of ten workers will be disabled before reaching retirement age and that 12 percent of the population is currently disabled; almost fifty percent of these people are of working age.

Many employers offer disability insurance as part of their benefits package. If your employer does not offer disability insurance, it is advisable to take out your insurance with a private insurer. The best policies provide income replacement of about fifty to sixty percent of your income. Premiums vary widely based on your age, current health status, and lifestyle.

3. Car insurance

Laws vary from country to country, but the importance of auto insurance remains constant. Although it is not a legal requirement for you to have car insurance where you live, it is strongly recommended that you have some form of policy as you will still have financial responsibility in the event of an accident.

If the law requires you to have car insurance in your country of residence, you could face a hefty fine if you don’t have a policy. In addition, your vehicle is often one of your most valuable assets and if it is damaged in an accident, you may struggle to pay for the repair or replacement. You could also be held liable for injury suffered by your passengers or the driver of another vehicle and for damage caused to another vehicle as a result of your negligence.

Insurance policies can be expensive, and it can be tempting to think we don’t need them. However, certain policies can protect you from financial ruin, so it’s worth taking out

Life insurance, health insurance, disability insurance, and auto insurance are four of the most important insurance products to consider when planning your financial future. An experienced insurance broker or financial advisor can discuss your options with you and help you find coverage that will protect you and your family in the worst-case scenario.

Car insurance without deposit

How to find auto insurers that offer no deposit and low deposit options?

Several insurers offer you the option of paying for your car insurance in manageable monthly installments, and some even offer car insurance with no down payment. Note, however, that you may be charged interest for the privilege of paying monthly and often require a deposit of around 20% upfront.

However, there are car insurance companies that will allow you to pay monthly with only a very small down payment, and if you search hard enough you will find companies that don’t require any down payment at all.

Insurance without license

By law, you do not need to have a driver’s license to take out insurance. However, most insurers do not provide coverage for drivers without a license. Most national insurers — like Geico, State Farm, Progressive, and Allstate — won’t offer you a quote without a license.

Is it legal to drive without insurance?

You cannot legally drive in any state without showing financial responsibility for damage or liability in the event of an accident. Auto insurance is mandatory in most states as proof of this responsibility.

All states have financial responsibility laws. In states that don’t require liability insurance, you must have proof of sufficient assets to pay for damages, medical bills, and more if you cause an accident.

Without this proof of assets, you face legal sanctions (e.g. withdrawal of driving license and vehicle registration). Worse, in the event of an accident, your responsibilities could wipe out your financial future.

4. Household insurance

Contents insurance protects everything in your house against theft, fire, willful or weather damage (storm, flood, lightning). If you want these items to also be insured against accidental damage – e.g. If you spill coffee on your expensive sound system – then an additional optional cover can be removed.

5. Travel Insurance Coverage COVID-19

Several travel insurers are now offering limited coverage for COVID-19 and the coverage available varies widely. Some policies only cover medical and repatriation costs if you catch COVID-19 abroad, while other policies offer limited coverage for cancellation costs in addition to medical and repatriation costs. Most policies that cover cancellation costs will cover cancellation or change costs if you:

- Get COVID-19 before you leave

- Get COVID-19 on your journey

Need to isolate yourself at home because you are in close contact with someone with COVID-19.

There are cooling-off periods for COVID-19 cancellation protection, so as always it’s best to purchase your travel insurance at the same time you book your trip. Some insurers only cover cancellation if you test positive for COVID-19 and the policy was purchased more than 21 days before your scheduled departure date.

The cancellation policy also usually covers additional expenses for quarantine costs if you catch COVID-19 abroad. However, there are several exclusions and limitations to look out for in your travel insurance COVID coverage.

Not all cancellation policies cover cancellations or additional quarantine costs if you are considered a close contact abroad. Many policies limit coverage for cancellations and additional expenses to just $2500 combined.

Travel insurance is unlikely to cover cancellation if you are unable to travel due to general travel restrictions, such as lockdowns at home or your intended destination.

6. Pet insurance

Pet insurance can help manage the healthcare costs for your pets.

Pet insurance becomes more reliable related to their health. It may cover costs related to certain illnesses or veterinary treatments. This can help make healthcare more affordable for your dog or cat and give you extra quality time with your four-legged family members. The GEICO insurance agency will help you take out comprehensive pet insurance for your dogs and cats.

2. Life Insurance

There are different types of life insurance. The following are the most common types of life insurance plans:

- Term life insurance

- Full life insurance

- Endowment plans

- Unit Linked Insurance Plans

Read more about the four types of Life Insurance here.

3. Usage-Based Insurance (or UBI)

Can insurance companies legally track your phone?

An insurance company cannot unilaterally decide to track your phone. That would be an invasion of privacy and most likely illegal. However, technologies are deployed that use your phone as a reporting device, provided you give your permission.

One of the more exciting areas of insurance is a development known as Usage-Based Insurance (or UBI). The concept is simple. Use more, pay more. A perfect example is a US auto insurance company called MetroMile. The premium you pay is based on the number of kilometers you drive per year.

Today, AFIK MetroMile will ask you to estimate how many miles you drive and then confirm how many miles you drove at the end of the coverage period. The premium is then adjusted up or down depending on the kilometers driven.

Other UBI insurers use technical means to track driving and driving behavior. Several insurers in the United States and around the world offer electronic devices that plug into your vehicle’s accessory socket. These devices report back to the insurer. A Quebec-based insurer is developing a version of the UBI tracking tool that won’t plug into your car. It’s an app on your phone. When you agree to insurance, the company calculates your premiums by observing your trips through your mobile phone.

4. Reinsurance

Some companies take out reinsurance to reduce risk. Reinsurance is insurance that insurance companies buy to protect against excessive losses due to high risk. For example, an insurance company may underwrite too much hurricane insurance based on models that show a low probability of a hurricane damaging a geographic area. Should the unimaginable happen in a hurricane in this region, the insurance company could suffer significant losses. Without reinsurance to take some of the risks off the table, insurance companies could go out of business in the event of a natural catastrophe.

Reinsurance is an integral part of insurance companies’ efforts to keep themselves solvent and avoid defaults due to payouts. Also, regulators require companies of a certain size and type to do so. Regulators dictate that an insurance company can only issue a policy capped at 10% of its value if it is not reinsured. Thus, reinsurance enables insurers to gain market share more aggressively because they can transfer risk. In addition, reinsurance smooths out the natural volatility of insurance companies, which can result in significant variances in profits and losses.

For many insurance companies, it’s like arbitrage. They charge individual consumers a higher insurance rate and then receive lower rates that reinsure those policies to a large extent.

Other Relevant Topics

Insurance Agent as a career

Insurance Agent (or Agent or Captive Agent) An insurance agent is a person who works for an insurance company and sells that company’s insurance products. An important aspect of working with an agent is that he/she only sells insurance products from one company and is therefore usually unable and uninterested in comparing prices and features of other products on the market. Agents should not be confused with brokers (or insurance brokers), who are typically able to compare products from multiple insurance providers.

Typically, an insurance agent receives a salary paid by an insurance company, and he/she may also receive a sales-based commission or bonus. Often a broker will be interested in selling additional products from the same company (e.g. selling you short-term life insurance initially and later offering disability and/or critical illness coverage). Some companies like State Farm only work with agents and therefore their products do not appear among the products offered by brokers.

There is an additional category of agents, called independent agents, who can work with different companies in a similar way to insurance brokers.

Insurance vs Banking Career

So there are many opportunities in the banking sector. Banking is better than insurance because most jobs in insurance are based on sales targets. The banking sector has a better career as in this sector you get a good salary package and many other conveniences like travel, house rent, etc.

What types of insurance is Haram in Islam?

Conventional insurance is haram in Islam. Whether life insurance, car, health, household, or even commercial insurance. That is because insurance includes non-Shariah elements of interest (riba), gambling (qimar), and insecurity (gharar). Which are all haram (forbidden) in Islam.