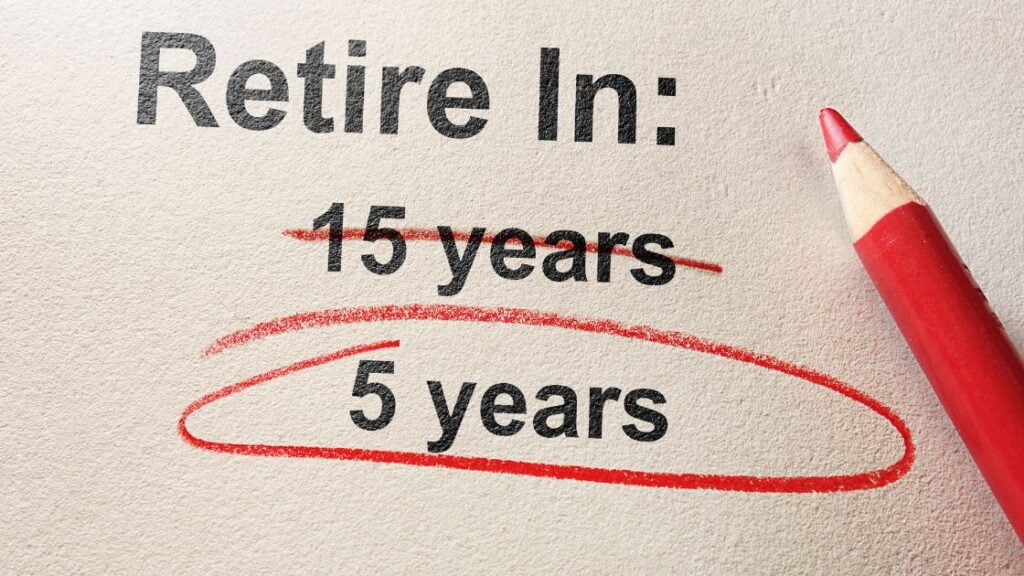

First, this post is not generic for saving money but specific and detailed, with early retirement and financial freedom as the focus. If you do not know about financial freedom, read this post first. If you are here to learn to save money to retire early and gain financial independence, you need to have a solid plan. Based on your current income sources and expenses, you need to figure out how much you can save and how many years you can retire if you save that much. Not happy with the outcome? Here is what you can do to save more money to change the number of years you can retire.

- Cut down your expenses

- Increase your income-generating sources

But what if you are already working the longest hours possible? Let’s be real job market is in ugly shape; finding a job is hard in the competitive job market, and employees are getting paid less and less with every passing day. Most of our skills are being replaced by automated machines and software that can do it better and faster. Technology is taking over our jobs; thus, it is more the reason to stop relying on our job as an income source.

What can be done? Invest money in businesses and ideas to generate passive income. Passive income is the money you earn through your investment without actively working to generate profit. To invest, you need to save first, so let’s dig into how to save money.

Before I move on to the ideas to increase your monthly saving, I would like to pitch two ideas that will help you stay focused on your goal and be more organized.

How to Spend Less and Save More?

- I recommend you get yourself a Journal to set the numbers in ink, write down your goals, and track your progress to stay focused.

- It will also help to leave reminders about your goals and progress around the house where you can easily see them and be mindful of your financial situation. Scribble down your last week’s progress and coming week’s goals on the stick it on your fridge and mirror. Don’t forget to update that regularly.

1. Setting Goals

Now you will be saving money based on your income and expenses. Of course, it is easy to calculate your income, but figuring out your expenses which may fluctuate from month to month, can be a little daunting. And if you have never given much thought about how much you are spending each month or annually, it can be very mind-boggling. Here is what you need to figure out your AVERAGE monthly goals.

Start collecting your receipts from all your months in a jar. You do not get a receipt for expenses; just scribble them down on paper and put them in the jar. At the end of the month, take out the receipts and calculate how much you splendid in that month.

Or you can get this amazing app, Every Dollar, for free to track your income and expenses. It helps you work on multiple devices and sync your data across your devices so you can access your budget wherever you are. Do this for three to four months and determine your average monthly expenses. Now that you know your monthly expenses, the money you earn, and how much you need to save, it should be easy to calculate the amount you need to cut down your expenses.

Another way to save money is by cutting down on your expenses

2. Throw Your Credit Card Out of Window

Remember the first episode of season 1 of Friends when Monica made Rachel cut her Credit Cards into tiny little pieces? You need to do exactly that! Not only was it a very empowering moment that changed the direction of Rachel’s life, but I would also say it conveyed a very strong message about credit cards. This is your real first step towards financial independence and saving money.

Research backs up the fact that if you are paying via credit card, you spend more than if you were paying in cash. Credit cards have to be one of the worst scams in the world that are legal. They make you believe you have the money you don’t have and encourage you to spend the money you don’t have, and if you cannot return the money you never had, they charge you interest! Get rid of that nasty thing right away. If you must shop online or hate to carry cash with you, opt for a debit card; that way, you only spend your money in your account.

3. Get Rid of all the Debit

Before you start saving for your retirement, you need to pay off all your debts which are increasing by the day due to the interest rate. The Sooner you pay them off less you pay in terms of interest. Any monthly debit payments rob you of your income, and thus you will not be able to save much. Use the Debit Snowball Method to pay off your debts by paying smaller loans and moving to the bigger ones.

This is more about behavioural change or a change in attitude that will help you stick to the plan by gradually increasing your paying-off capacity. By paying off smaller loans, you will be left with more money which will help you pay off the larger loan.

Another approach to paying off the debt is Avalanche Method by paying the highest interest rate loan (bad debt) first. This way, the interest that is eating your income more will decrease quicker. The plan is to pay the minimum payment of all your debts and put extra money into paying back the debt with the highest interest rate. Once that highest interest rate loan is paid off, you can move to the second highest one. Read more strategies to pay off your debt here.

You should also consider refinancing your monthly car payments and mortgage instalments to lower interest rate options. It’s crazy how some people are unaware that these options exist and just opt for smaller instalments for longer duration without knowing it means more interest to pay. This can save you some serious money and make you debt-free sooner.

4. Backup plan Savings

Before you start saving for your retirement plan, you need to save for a backup plan. Many people do not succeed in achieving financial independence because life is unpredictable, and they do not account for that. Life happens, and things go wrong all the time. Halfway through your plan to save and invest for your retirement, you lose your job, or maybe a huge unexpected expense comes up, or one of your income sources shuts down, so what do you do then? You have no option but to withdraw money and spend from your investment until you get back on track.

This can be a setback for your progress towards achieving financial independence unless you have savings set aside as a backup plan. You must set aside an amount to cover at least 5 to 6-month expenses. Turn this money into a fixed deposit in your bank account so that your money keeps growing while sitting in the account, and you can withdraw it in case of an emergency.

4. Open a Saving account

Convert one of your bank accounts to save money and automate your savings by setting up your bank accounts to automatically transfer 10 to 20% of your paycheck into the savings account. This is called the Pay Yourself First Strategy, which lets you save before you even start spending; this way, saving comes before spending. This will be a great start to saving money as It will help you save money without actively doing anything about it.

Opt for a Low Budget LifeStyle

If you are going to start saving money, you need to spend it more sensibly.

- Buy clothes and shoes only when you have to (this goes for everything you purchase too). Instead, mix and match to achieve a new look with old clothes.b

- Repurpose your wardrobe by converting worn-out pants into shorts and dresses into crop tops.

- Stop buying ornaments, decoration pieces, and jewellery for yourself. You do not need that junk.

- Buy smaller packaging of makeup products so that you pay for only the amount you will be using before it expires. Here is a list of some high-end branded makeup products for less than 10$.

- Learn anything from YouTube tutorials. You can save a lot of money you spend every month on manicures, skincare, haircare, repairing electronics, and car maintenance.

- When shopping, make a list of things you “need” and stick to it; do not indulge in impulsive buying of unnecessary items.

- Frequent dollar stores and see what utilities and stationary you can get from there are an alternative to relatively expensive options you buy otherwise.

- Opt for cheaper brands while shopping for utilities; you will be surprised that in lower-quality packaging, they are the same thing, and big brands are just cashing their popularity.

- Subscribe to offers for free samples and trial packages.

- Think about buying recycled or used things that are in good condition.

- Check the internet for cheaper options before purchasing, and thoroughly research.

- If you want to buy something, take a day or two to think if you want it. This will help you control impulsive buying, which is fairly common for online shopping.

- See if you can borrow (a dress or a gadget) from a friend or neighbour instead of buying it if you are going to use it once or twice in your lifetime.

- Cut your cable connection; it’s really expensive; instead, keep yourself entertained with loads of free content available for streaming online.

- Try walking or riding a bicycle to your destination or taking local transport instead of a cab or Uber.

- Instead of buying a membership to a gym, go for a walk or to, jog in a park or ride a bicycle.

- Learn to cook and eat more homemade food. It is also as good for your health as for your budget.

- Pack yourself a lunch that you cooked rather than purchasing your meal.

- Instead of buying a Champaign or any other expensive gift, take homemade frozen meals as a gift to housewarming parties and baby showers. They will appreciate it more. Here are some 20$ to 50$ gift ideas for newborn babies if you are interested.

- Be mindful of electricity usage, and don’t leave an electrical appliance on when not in use.

- Cut down on alcohol consumption (even beer); it is expensive. Even better if you stop drinking it at all. The same goes for smoking and recreational drugs.

- Instead of going to a bar, invite friends and have beers while watching sports. That way, you cut down on alcohol consumption too.

- Try to Netflix and chill at home with your friends instead of going to cinemas.

- You can also invite friends to hang out at your home instead of treating them at a fancy restaurant.

- Collect discount coupons every time you shop to inquire about special discounts.

Earn More from Passive Income Sources

Majorly experts recommend three sources of Passive Income; Stocks, Bonds, and Real Estate Websites I can tell you there are a lot more opportunities but I will designate an entirely separate post for that as this is already very long and detailed.

5 thoughts on “How to Save Money For Retirement Fast?”

I appreciate you sharing this awesome page. It’s really helped me.

Excellent post, we will repeat this on our new blog page. Many thanks for sharing.

Been taught a bunch. Easy to fully grasp. Thanks for sharing with us 🙂

I’m glad I found this site. I read it with great interest, it has valuable information, which is why I

want to help others how to earn from home with real jobs, without scams: https://bit.ly/2RbR38c